The platform has built a network of freelancers, who sell and distribute financial products, including insurances and large-ticket family loans.

The startup offers loans through its registered NBFC with an average ticket size of Rs 1 lakh with no upper limit. The majority of the loans are towards use cases like weddings and education, and are customized after careful evaluation of the family’s needs and payback capability.

The second product is insurance, which is sold via partnerships with organizations. The startup creates customized insurances in partnership with an undisclosed large provider besides other 4-5 companies. The interest rates also vary and depend on the risk model created by the proprietary tech. They may even go slightly above the range offered by the traditional banks and NBFCs.

Now, one of the newest power couples in the town is social finance. Taking the first mover’s advantage in this segment is Bangalore-based fintech startup WeRize

WeRize is a socially distributed financial services platform, which offers customised credit, group insurance, and savings products to users residing in small towns in India.

One, the banking sector was extremely underpenetrated, and second, financial products (loans, insurance, policies) were mostly restricted to top tier cities.

Future

The unique social distribution model has so far allowed WeRize to collect over one billion data points across 500,000 families in 1,000 cities.

The platform will continue to leverage these insights to create new products, including saving-based instruments in the near future.

Get Easy Personal Loans For All Your Requirements Fulfillment With MoneyOnClick

MoneyOnClick [MOC] Is A Brand Owned By Wortgage Technologies Pvt Ltd. Rebranding As A WeRize . MOC Partners With Multiple NBFCs Including Our NBFC Subsidiary Company Wortgage Finance Pvt Ltd To Help Fulfil The Financial Requirements Of Our Customers.

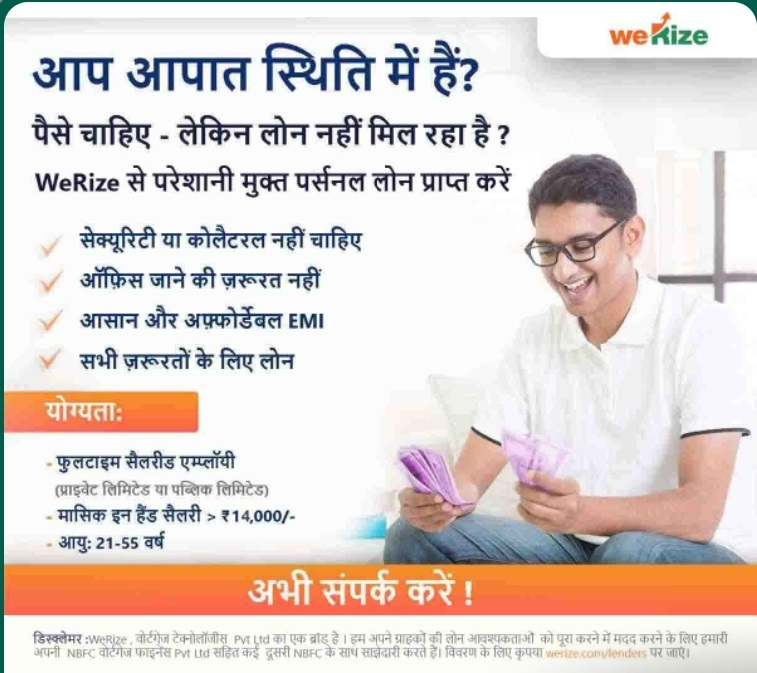

Loan Amount Starting From Rs. 50,000/- To Rs. 5,00,000/-

We Provides Unsecured Personal Loans And Insurance To Undeserved Customers. Loan Amount Starts From Rs.50,000. Get Loan For Wedding, Medical Emergency & Other Needs Fulfillment.

Salary More Than 12,000 In Bank Credit [ Cash Or Cheque Is Not Consider] PF Diduction is Compulsary.

We Are Building India’s Largest Financial Services Brand For The 500 Mn Lower Middle Income Customers In 4000+ Small Cities (Which We Call “India 4”). This Customer Segment Has Very Little Penetration Of Formal Loans [Financial Services] , Saving Products Or Insurance As Existing Financial Service Players See This Segment As Risky And Nonprofitable In This Segment . We Have Created Custom Lending, Insurance And Saving Products That Are Tailor-Made To Serve The Needs Of India4 Customers.

✔ No Need To Visit Any Branch

✔ Flexible Repayment Options For Your Salary Basis

✔ Interest Rates Is Starting From 1.25% Per Month

✔ No Gold, No Collateral!

How Is MoneyonClick Different From Others?

We Provide Loans At Only 1.5 To 2% Per Month Vs Very High Interest Rates Charged By Local Moneylenders

We Are A Technology-Focused Company With Processes And Policies That Enables Us To Provide Faster And More Accurate Delivery Of Our Services Digitally.

Our Pan-India Partner Network Enables Us To Provide Consultation To The End-Customer At A Personal Level And Offer Them Customized Solutions Anytime.

Our Entire Process Is Online[Digitally], So The Customer Will Not Have To Face Any Hassle Of Making Multiple Visits To The Branch

Repayment For The Loan Is Customized To Suit The Needs And Eligibility Of The Customers

We Provide Services Across All Locations And Regions Within India And Don’t Have A Geographical Limit/Restraint For It

We Maintain Complete Transparency For Services, There Are No Any Hidden Charges.

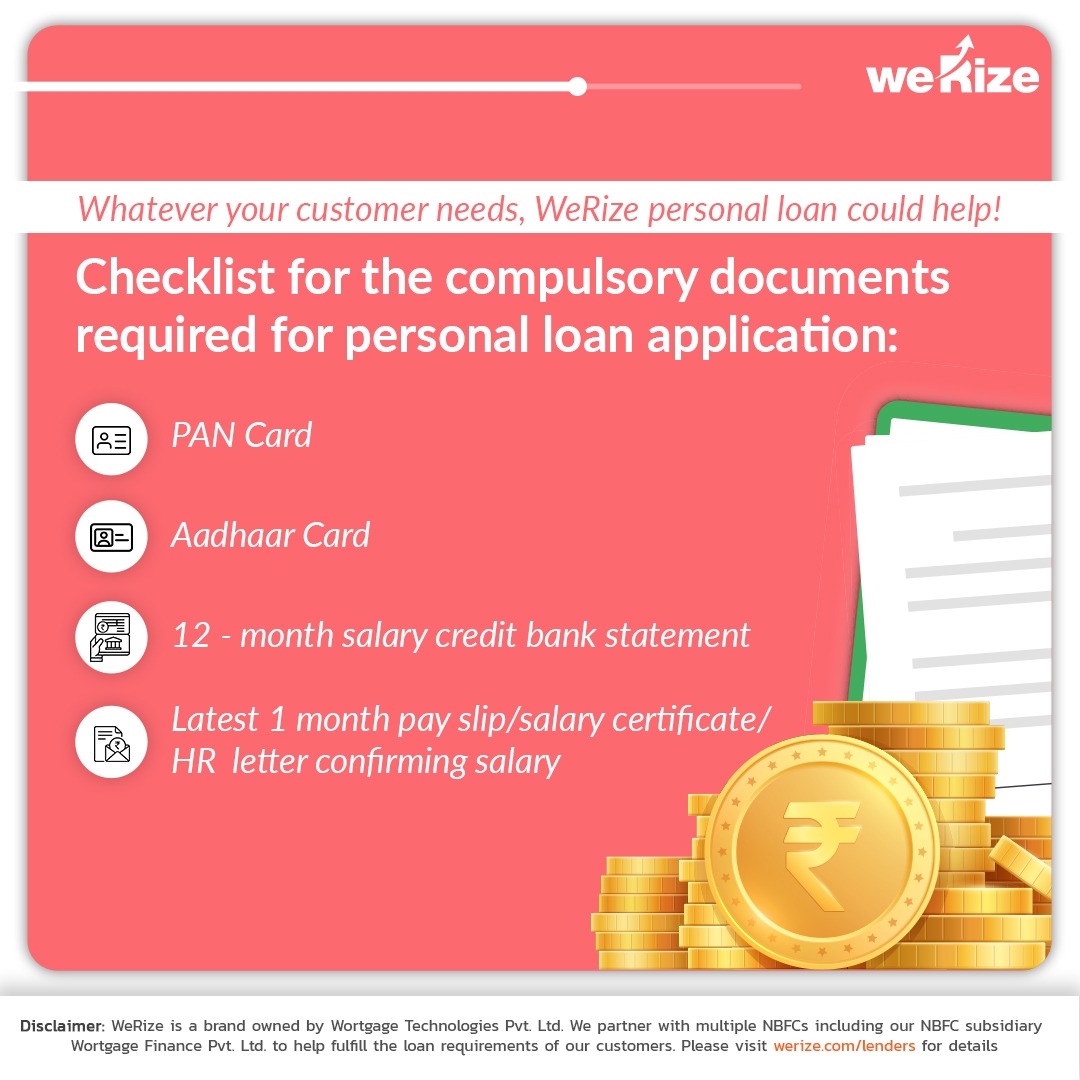

Documents:

✔ Pan Card

✔ Aadhar Card

✔ Last 12 Month Banking [Online Downloaded PDF Compulsory]

✔ Last Month Salary Slip

✔ Ownership Proof Only [If loan more than 2 Lakh]

Get Loan Easy And Enjoy Your Financial Freedom.

At WeRize, we are creating a new category in Indian financial services space. We are building, India’s first socially distributed full stack fintech platform for middle class families in tier 2-4 cities. The financial needs of small-city India have been largely underserved since traditional players and even fintechs are unable to properly serve this segment

- We have raised $25.75Mn equity ($115.5 Mn valuation) from British International Investment (UK Government’s sovereign impact fund formally known as CDC), Sony Japan, 3one4 Capital, Kalaari, Pic.

- WeRize is a full-stack provider, both manufacturing and distributing a wide portfolio of customized credit, insurance, and savings products for 300Mn individuals spread across the 4000+ Tier 2 to Tier 4 towns .

- Families in small towns require high touch sales/after-sales service which can only be profitably provided using a social distribution model. The entire Indian fintech ecosystem is geared towards building DIY apps that help customers choose the right financial products for themselves. However, this approach doesn’t work for small-town families as they need high touch sales and after sales. Additionally, due to lower ticket-size/conversions vs tier-1 city millennial customers, digital CAC unit economics dont work, leading to fintechs staying away from this superb segment

*Using the “Social Shopify of Finance” platform, WeRize has enabled thousands of financially literate freelancers in 1000+ cities to sell its financial products in their social circle. This solves trust issue as well as provides high-touch sales/after-sales .

- Werize is the only Indian fintech platform/financial services player that has been able to distribute financial services through freelancers without any of its own feet-on-street/local branches. Our freelancers in 1000+ cities are managed only through Werize proprietary tech platform.

Wortgage finance private limited holds RBI NBFC license (N-02.00325) which enables us to conduct lending activities in India.

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla personal loans: …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual Funds, Fixed …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and start from …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of up to …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where You Can …