Privo is an instant credit line and personal loan app from Kisetsu Saison Finance (India) Pvt Ltd or Credit Saison India (CS India), one of the leading neo-lending conglomerates in India. Adhering to the RBI’s Fair Practice Code, Privo is committed to ensuring transparency while lending loans to customers digitally.

Are you in need of an instant loan?

Then Privo is what you need. Get an instant credit line up to Rs. 2 Lakhs to fulfill all your needs

Credit Saison India [Kisetsu Saison Finance India Pvt. Ltd.] is a fully owned subsidiary of Credit Saison Co. Ltd, which is one of the largest credit card/prepaid card issuers in Japan.

We are a tech led NBFC with a startup DNA but an enterprise mindset.

Get an instant personal loan that you can repay and reuse through a credit line on Privo. Get instant credit upto ₹2 lakhs in three simple steps!

Why you should apply from here:

✔️ 100% Fast and Secure

✔️ Paperless Documentation

Benefits Of Using Privo

- Pay Interest Only On The Amount You Use: Open a Credit Line of up to ₹2

lakhs at Privo and pay interest only on the amount you withdraw. - Lower Interest Rate compared to credit cards: Loans start as low as 13.49% per annum, while the maximum interest rate is 29.99% per annum.

- Get An Instant Loan Amount: Borrow any sum of money (from ₹20,000) from your approved credit limit (upto ₹2 lakhs) for 3 months to 60 months.

- No Hidden Fees or line set up fees: Privo doesn’t charge any hidden fee for opening a Credit Line or withdrawing money.

- EMI Repayment Offers: You can select EMI options to repay the borrowed amount.

- 100% Paperless: Privo provides a fully digital and paperless experience, ensuring easy approvals of credit lines

- Safe And Secure Process: Get instant credit with this safe app designed using advanced encrypted technologies.

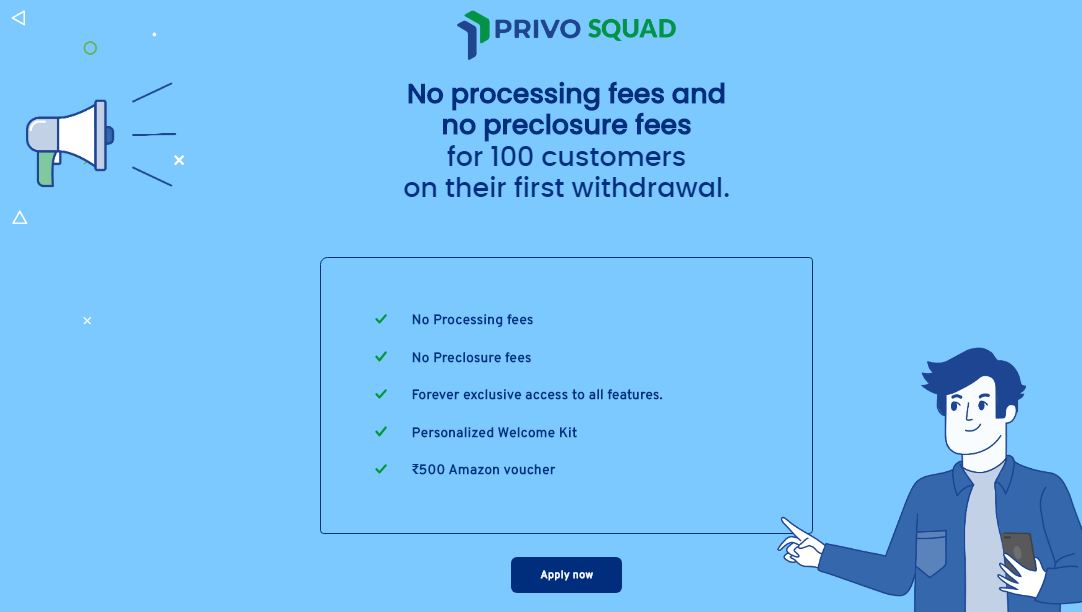

Privo Squad Offers to give you something extra!

Zero processing & foreclosure fee

Personalised welcome kit.

An Amazon voucher of ₹500.

Exclusive access to the premium features of Privo forever.

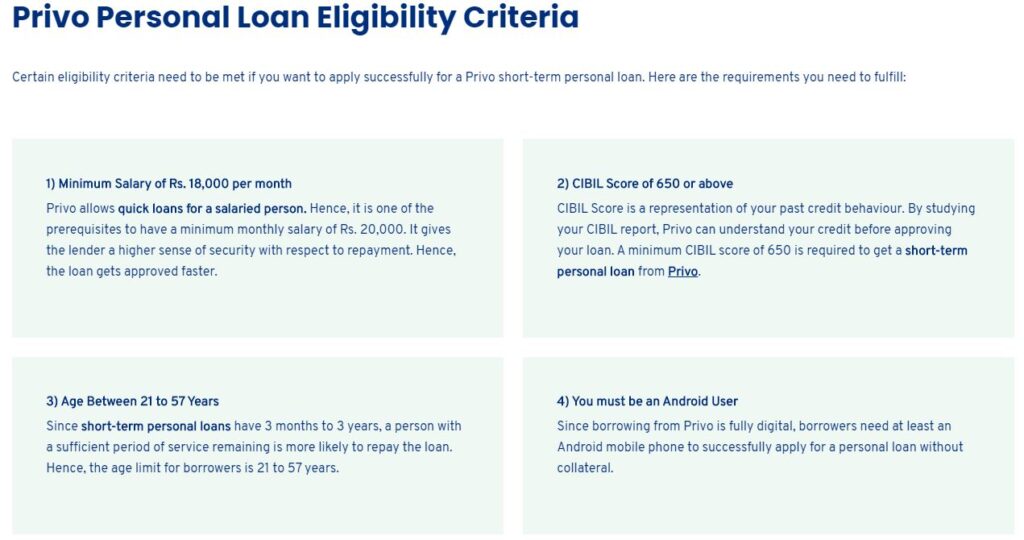

Eligibility Criteria for opening an Instant Credit Line at Privo

The person should be aged between 21 to 57 years.

He must be a salaried employee with a monthly income of ₹18,000 or above.

A minimum CIBIL score of 650.

The individual must have an Android phone

In short, Privo credit line offers the below features to its customers

- Loans range from ₹20,000 to ₹2,00,000

- Tenure: Min. 3 months | Max. 60 months

- Interest rate: Min 13.49% pa | Max 29.99% pa

- Processing fee – Min 1% | Max 3%*

*not applicable for PRIVO SQUAD

*GST applicable on the processing fee

Documents Required

Since Privo is a digital finance app, all you need to do is enter your PAN and Aadhar number linked with your phone number and take a selfie.

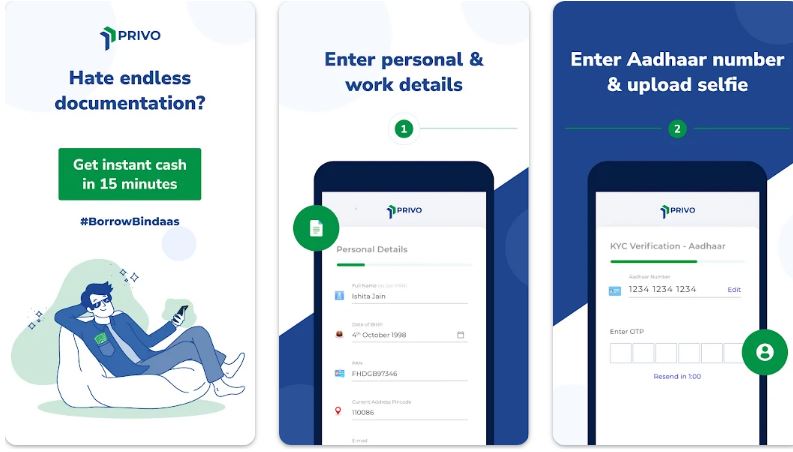

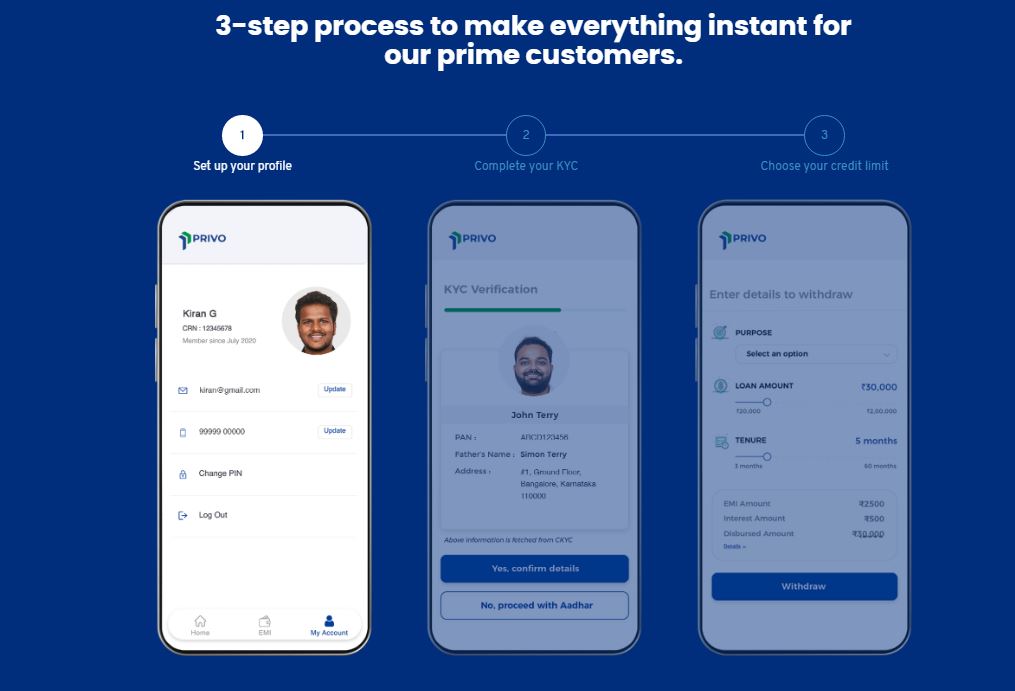

How Does Privo Work?

STEP 1: Download the Privo app and set up your profile.

STEP 2: Complete the KYC process and set up auto pay

STEP 3: Choose an amount based on your need

Uses of Privo’s Instant Line of Credit

- 💳 Refinancing

- 🎊 Wedding loan for marriage expenses

- 🛩 Travel loan

- 🏘 Home renovation loan

- 🚙 2 wheeler/4 wheeler loan

- 🙋♀️ Personal loan

- 💻 Mobile phone loan/Loan for a laptop/Consumer durables loan

- 💰 Instant cash loan

- 🎓 Education loans

- 👩⚕️ Medical emergencies

- 🧾️ Debt consolidation loan

PRIVO is a digital lending app of Credit Saison India – the Neo-lending subsidiary of Credit Saison. Credit Saison India is a technology-led neo-lending conglomerate with a Global MNC Parent. We offer bespoke solutions to cater to the different financial needs of Individuals, SMEs, Fintechs and NBFCs.

For Self Employyed:

You must fulfil these criteria to avail instant personal loan from Privo:

Minimum monthly income of Rs. 20,000: Getting a personal loan for self-employed is easy if you manage to make a minimum of Rs 20,000 per month.

CIBIL Score of 650 or above: A minimum of 650 CIBIL score will earn you an easy and fast instant loan for self-employed from Privo.

Age Between 21 to 57 Years: You should be 21-57 years to qualify for a personal loan.

You must be an Android User: Android users can download this easy-to-use app to get an instant personal loan sans any collaterals or processing fees.

You must be an Android User: You must enter your Aadhaar and PAN card details to complete the KYC and obtain the loan.

Additional Charges

Overdue Interest Rate: 36% p.a.

Full prepayment charges: 5% of outstanding amount + taxes* Part prepayment charges: 5% of outstanding amount + taxes*

Swap charges (Cheque/NACH): Rs 250/- + taxes

Dishonour charges: Rs 450/-

*not applicable for PRIVO SQUAD

Contact Us

More info about Privo: https://privo.in/

Our Parent Company info: https://creditsaison.in/

Privo’s privacy policy: https://www.creditsaison.in/privacy-policy

Email us at: support@creditsaison-in.com/support@privo.in

Call our customer care number: 18001038961

Address: Kisetsu Saison Finance (India) Private Limited, having CIN U65999KA2018FTC113783 and having its registered office at IndiQube Lexington Tower, First Floor, Tavarekere Main Rd, Tavarekere, S.G. Palya, Bengaluru, Karnataka 560029.

- WeRize Personal LoansThe platform has built a network of freelancers, who sell and distribute financial products, including insurances and large-ticket family loans. The startup offers loans through its registered NBFC with an average ticket size of Rs 1 …

- Get Marriage Loan at Lowest Interest Rates from FaircentFaircent is India’s first peer-to-peer (P2P) lending platform to receive a Certificate of Registration (CoR) as an NBFC-P2P from the Reserve Bank of India (RBI). Get Marriage Loan of upto 10 Lakhs at Lowest Interest Rates …

- Navi Finserv : Digital Personal LoansNavi operates in the space of digital Digital Loans, home loans, mutual funds, health insurance and micro-loans. Digital Personal Loans Personal Loans up to 20,00,000 with a tenure range up-to 84 months at 9-45% interest rate …

- Instant Personal Loan In IndiaCheck offer your Customer and Apply Loan Instant Eligibility check free ( पर्सनल लॉन का ऑफर चेक करे फ्री में अपने कस्टमर का और एप्लाई भी कर सकते ही) and Apply Free Instant. We get you …

- Apply for Instant Personal Loan Online – IIFL FinanceQuick and Easy Approval. No Collateral Required. Hassle-Free Process. Apply for more info. Calculate your Personal loan eligibility today. Minimum documentation required. Apply Now. For Salaried Employee IIFL Fully Digital Business Loan Upto 30 lakh