Prefr is an embedded financial services platform for MSMEs. Prefr, an NBFC owned by CreditVidya, offers instant personal loan up to Rs. 3 Lakhs to salaried as well as self-employed individuals for all business and personal requirements. Prefr loan involves a completely digital process with simplified documentation.

Factors That Determine Your Personal Loan Prefr Partners Interest Rate

Credit Score

A great credit score always helps you with a competitive interest rate. High credit score is always appreciated and makes your loan process smoother.

Monthly Revenue

Regular & stable income has a strong bearing on the repayment capability. We make it a point to analyse the daily average balance before deciding your personal loan interest rate.

Collateral

This means the security that you are willing to pledge for availing the personal loan. The higher the value of the secured asset, the higher the chances of you getting the personal loan at an affordable interest rate. Collateral such as home equity, deposits, equipment and investment real estate can be pledged as a security.

Following are the key details of Prefr personal loan:

Loan amount Rs. 10,000 to Rs. 3 Lakhs

Eligible borrowers Salaried individuals and self-employed individuals

Purpose Wedding, events, home renovation, business needs, personal use, education, medical emergency & loan repayment

Tenure 6 to 36 months

Rate of interest 18% to 36% per annum

Processing Fee 3% to 5% of the loan amount

Disbursal TAT Within 2 hours after document verification.

Purpose:

Wedding / Event

Medical Emergency

Home Renovation

Travel

Business Requirement

Repayment of another loan

Education

Personal Use

Fast flexible Loan to meet your personal requirements

✔️Borrow loans from Rs.25,000 to Rs. 3,00,000

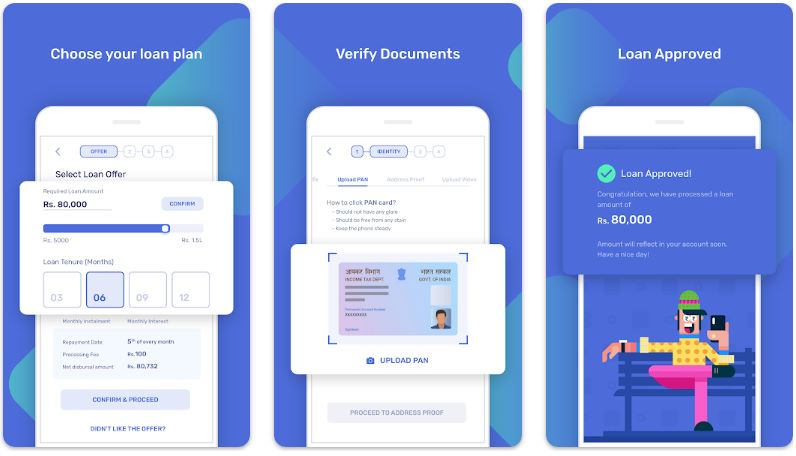

✔️100% digital & paperless process

✔️No Collaterals

✔️Tenure – 3 to 42 Months

✔️Fast disbursal

Following are some attractive features of Prefr loans:

Get an instant personal loan from Rs. 10,000 up to Rs. 3,00,000 for not just personal but also professional needs.

Prefr loan interest rate ranges from 18% to 36% per annum.

A processing fee of 3% to 5% of the loan amount, subject to a minimum of Rs. 1,500 + GST, will be charged.

No security is required to be kept with Prefr to get a loan.

Prefr loan app offers Term Loans for Self-Employed with flexible tenure ranging from 6 to 36 months that will help them grow their business.

Prefr offers Personal Loan for Salaried for their medical, home upgrade, wedding expenses and other personal needs for tenure ranging from 6 to 18 months with easy EMIs.

No CIBIL score is required as Prefr uses borrower’s banking data to generate their offer.

Get loan approval in just one minute flat once you provide all the necessary details.

Money will be disbursed to your bank account within 2 hours after successful document verification.

Prefr is a great platform for availing of a personal loan. To know about its benefits, you can read Prefr loan reviews online

Other Key Features:

Collateral free loan facility with EMI feature.

Paperless Journey

Easy and automated repayments

3 Days Cooling off Period

Loan amount upto Rs. 5,00,000/-

Disbursement directly to customer’s bank account

Flexible Tenure Options

Easy & Quick disbursement process

Benefits:

Simplified digital documentation

Completely on digital platform real time* approval and disbursement

Unsecured loan facility with daily installment structure

Prefr Personal Loan Types

Prefr provides the following two types of loans for meeting your personal and professional needs:

Term Loans for Self-Employed: This loan is offered to self-employed individuals with flexible tenure to help them grow their businesses.

Personal Loan for Salaried: These loans are offered to salaried individuals for any personal requirements, including medical, home upgrade, wedding expenses, etc. The tenure for this loan ranges from 6 to 18 months.

Prefr Personal Loan Documents Required

To get a Prefr personal loan, you just need to do the following three things:

- Click a Selfie

- Upload your PAN Card

- Upload your Address Proof document

- Voila; you are done.

Prefr Toll Free No. 040 48521334

Prefr loan customer care number: 70618 79075 (Toll-free)

Email: or wecare@prefr.com

Timings: 10:00 am – 7:00 pm (Available on all days except holidays and weekends)

Customer can raise their queries / concerns by email: wecare@prefr.com or info@prefr.com

Click and Apply Loan Online Instant

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla personal loans: Different financial needs, different loans,one app – ABCD For …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual Funds, Fixed Deposits, Personal Loans, Medical Loans, Home Loans, and Loan …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and start from just 18% per annum. The processing fee is up …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of up to 60 months👉🏻 Facility of transferring existing loan & credit …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where You Can Avail Instant Loans To Fulfill Various Financial Requirements Such …