Make It Happen. Now! PaySense offers instant personal loans for salaried employees up to Rs.10 Lakhs for all your needs like marriage, car, two-wheeler to home renovation, consumer durable & more.

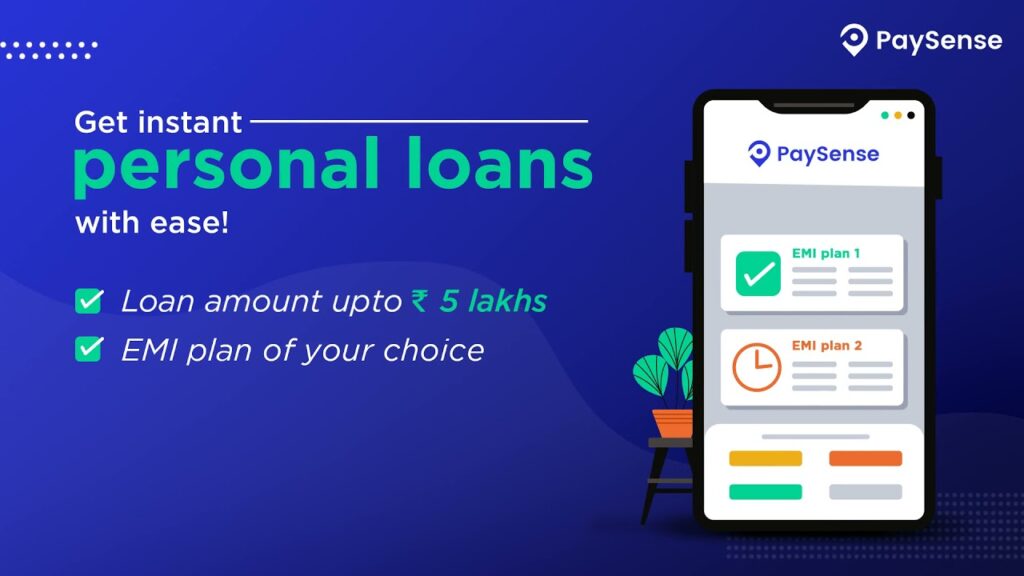

Get Personal Loan up to Rs. 5,00,000 Easily and Quickly on Fingertips.

100% Safe & Secure

Instant Process

Instant personal loans

Get instant personal loans from Rs.5000 to Rs.5 lakh to fit all your needs and dreams

Quick Approvals & Disbursal

Get prompt loan approval and money in your account

One-click subsequent personal loans

Need another loan from PaySense? With one-time documentation, it’s just a click away. No further checks required.

We have partnered with India’s leading NBFCs: Credit Saison India, Fullerton, IIFL, Northern Arc, PayUFinance, IDFC First Bank.

Are you eligible for a personal loan?

To be eligible to get a personal loan from PaySense, you should fulfil the following eligibility criteria

- Resident of India

- Age: 21 years to 60 years

- Employment Type: Salaried and Self-employed

- Minimum Monthly Income: Rs,18,000 for salaried and Rs. 20,000 for self-employed

- Location: We are active in 41+ cities. see availability

What are the documents required?

To get a personal loan instantly, you should keep some documents handy before you start applying.

- Proof of Identity PAN Card and Aadhaar Card

- Proof of Address: Aadhaar card, Rental agreement, Utility, or Postpaid bills

- Proof of Income: Last 3 months bank Statements

- A Selfie

Paysense is a digital lending platform that offers personal loans with various benefits, including:

- Quick and easy application process: Paysense offers a simple and user-friendly online application process that takes only a few minutes to complete.

- No collateral required: Paysense personal loans are unsecured, which means you don’t have to provide any collateral to secure the loan.

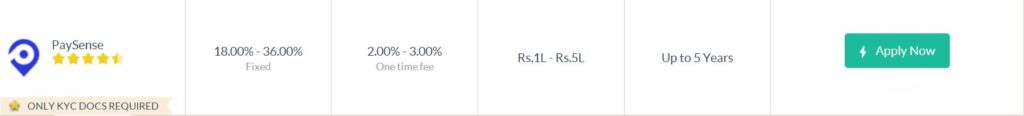

- Flexible repayment options: Paysense offers flexible repayment options ranging from 3 months to 60 months, which allows you to choose a repayment plan that suits your financial situation.

- Competitive interest rates: Paysense offers competitive interest rates that are affordable and reasonable compared to other lending platforms.

- High loan amount: Paysense offers a high loan amount of up to Rs. 5 lakhs, which allows you to borrow the amount you need for various purposes, such as home renovations, travel, medical expenses, or debt consolidation.

- Minimal documentation: Paysense requires minimal documentation to process your loan application, which makes the process faster and hassle-free.

- Quick disbursal: Paysense disburses the loan amount within 24 hours of approval, which means you can get access to the funds you need quickly.

Overall, Paysense offers a convenient and reliable way to obtain personal loans with flexible repayment options, competitive interest rates, and a hassle-free application process.

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla personal loans: Different financial needs, …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual Funds, Fixed Deposits, Personal Loans, …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and start from just 18% per …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of up to 60 months👉🏻 Facility …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where You Can Avail Instant Loans …