Get the new-age personal loan with India’s 1st credit line app.

- Use any amount from your limit

- Interest charged only on the used limit

- Flexible EMIs of 3-36 months available

- Repay and use the limit again

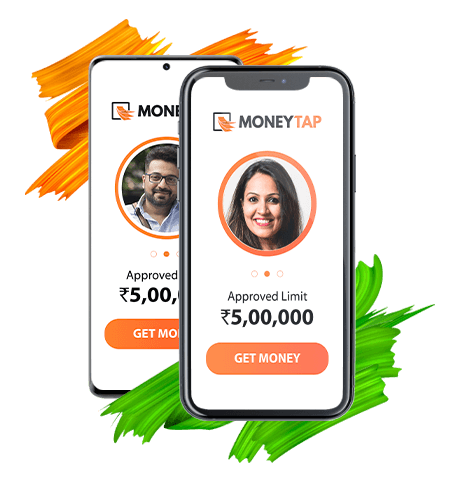

Get Approved For Up To ₹5 Lakh Instantly!

MoneyTap is a Credit Line and Instant Personal Loan App in India. Get Instant approval for a credit line of up to ₹5,00,000 & pay interest only on the amount you withdraw from your balance.

Our Interest rates starting from as low as 12%. Interest payable on the exact loan amount used from your approved credit line.

- Apply:

- Easy application, no bank visit required

- No collateral, no guarantor

- Quick approval of up to ₹5 Lakh

- Borrow:

- Borrow any amount starting at ₹3,000

- Pay interest only on the borrowed amount

- Instant transfer to your bank account

- Reuse:

- Choose your EMIs conveniently

- Repay your EMIs and re-use your limit

- One time approval, lifetime usage

What features make MoneyTap the best instant personal loan app in India?

● Borrow any amount or sum of money (starting at ₹3,000) from your approved Credit Line (up to ₹5 Lakh)

● Pay interest only on the amount you use

● Instant personal loan without any risk

● Make UPI transactions from your credit line

● Fully digital, paperless experience

● Select your own flexible EMIs & pay later

Documents required

● Aadhaar number

● Identity proof (Driving licence/Voter ID/Passport/Aadhaar/PAN)

● Address proof (Driving licence/Voter ID/Passport/Aadhaar/Utility bills/bank statements)

● Passport-sized photo/Selfie

● You can get a personal loan online on your Aadhaar card. E-sign your application with registered mobile OTP for fast-tracked application

Get an instant personal loan in 3 simple steps:

● Log on to the MoneyTap credit line app, enter information such as age, city, PAN, and income, and check your eligibility

● Complete KYC verification, submit documents online

● Transfer money to the bank account from the approved amount

मनीटैप की पर्सनल लाइन ऑफ क्रेडिट कैसे काम करती है?

चरण 1 – मनीटैप क्रेडिट लाइन ऐप डाउनलोड करें और रजिस्टर करें

एक सरल और सुरक्षित पंजीकरण प्रक्रिया के माध्यम से, अपनी उम्र, शहर, पैन नंबर, आय जैसे बेसिक विवरण भरें ताकि हम रियल टाइम में मनीटैप क्रेडिट लाइन के लिए आपकी योग्यता निर्धारित कर सकें।

चरण 2 – अपने केवाईसी दस्तावेजों को पूरा करें – अंतिम अप्रूवल के लिए

एक बार जब आप अपनी पूर्व-स्वीकृत लाइन ऑफ क्रेडिट राशि प्राप्त कर लेते हैं, तो हम अंतिम अप्रूवल के लिए अपने केवाईसी पार्टनर्स के द्वारा आपके दस्तावेजों को इकठ्ठा करने के लिए केवाईसी विजिट का समय निर्धारित करेंगे।

चरण 3 – एक टैप के साथ नक़द या कार्ड के रूप में उपयोग करना शुरू करें!

मनी टैप को प्राप्त करें ! एक बार जब आपको अंतिम स्वीकृति मिल जाती है, तो आपकी क्रेडिट लाइन उपयोग के लिए तैयार हो जाती है।

- कम से कम 3,000, या आपकी स्वीकृत सीमा तक 24/7 तक उधार लें।

- कभी भी , कहीं भी अपने मनीटैप क्रेडिट कार्ड का उपयोग करें।

- अब आपको आपात स्थिति के लिए एक बड़े भाई की आवश्यकता नहीं है!

चरण 4 – फ्लेक्सिबल ईएमआई में बदलने के लिए एक टैप

एक टैप के साथ एप्लिकेशन से 2-36 महीने की फ्लेक्सिबल ईएमआई में अपनी उधार ली गई राशि को चुकाएं।

चरण 5 – अपने सभी लेन-देन को ट्रैक करें करती है?

अपने मनीटैप खाते के माध्यम से अपने सभी लेन-देन और विवरण, ईएमआई और उपलब्ध क्रेडिट सीमा का ट्रैक रखें।

Features and Benefits of Money Tap

- Apply for any amount of short term loan from the approved credit line.

- The interest shall apply to the amount that is borrowed and not to the amount that is approved.

- The credit limit will be available for a lifetime.

- There is no need for any security or collateral to apply for a Monteytap loan

- Quick approval of loans because the documentation process will be digital.

- MoneyTap short term loans are available at an interest rate of just 1.08% per month.

Is MoneyTap approved by the RBI?

Yes, MoneyTap is approved by the RBI to lend personal loans to individuals. They have their own NBFC license and the RBI regulates and monitors MoneyTap

Can I apply for a Money tap Personal loan without a Bank account?

No, you can’t apply for the Money Tap personal loan without a bank account because they always transfer the loan amount to a bank account only. But Yes, you can apply for the MoneyTap loan if you don’t have an account with the partnered bank.

What is the maximum amount on a MoneyTap personal loan?

The maximum amount of the MoneyTap personal loan is INR 5,00,000.

How much is the Money Tap Personal Loan interest rate?

The Money Tap Personal Loan Interest Rate is 1.08% per month and it can be as low as 13% per annum.

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla personal loans: Different financial needs, different loans,one …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual Funds, Fixed Deposits, Personal Loans, Medical Loans, …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and start from just 18% per annum. The …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of up to 60 months👉🏻 Facility of transferring …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where You Can Avail Instant Loans To Fulfill …