Money View provides collateral-free personal loans in a few hours. From application to disbursal, the loan application process on Money View is entirely digital. The app lets you track your loan status, understand verification information, and keeps you updated about your upcoming EMI payments.

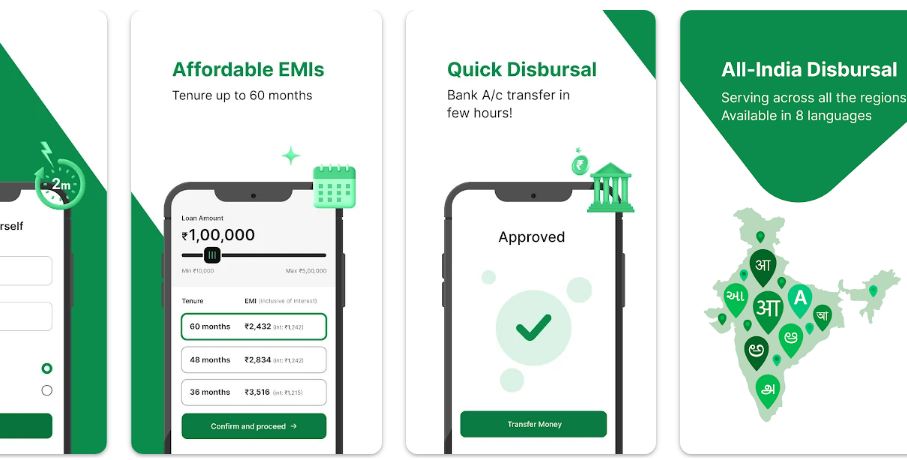

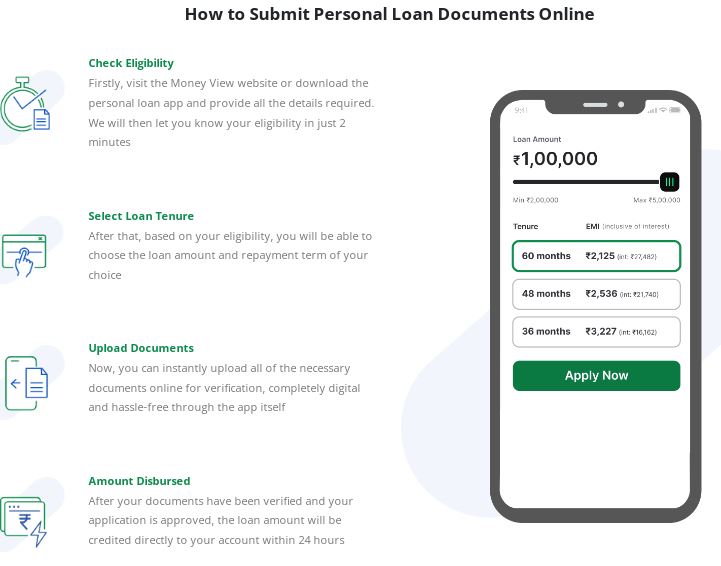

Money View offers Instant Personal Loans @ 1.33% per month onwards for loan amounts of up to Rs 5 lakh and for tenures of up to 5 years. Personal loan applicants can check their eligibility within 2 minutes and can get their loan amount disbursed within 24 hours of approval. The entire process from loan application to disbursement is completely digital.

Money View has developed an alternative credit-scoring model to help applicants with low credit scores to get personal loans. However, applicants need to have a minimum CIBIL score of 600 or Experian score of at least 650 to avail personal loan from Money View.

Moneyview is trusted by more than 1Cr users across India.

Documents required to Apply

To apply for a loan through the app, you will need to upload the following documents:

Both salaried and self-employed individuals are eligible

Age: 21 to 57 years

CIBIL score of at least 600 or Experian score of at least 650

Minimum Income in-hand (per month):

For salaried –

Rs 20,000 for Mumbai/Thane or NCR

Rs 15,000 for metro cities other than Mumbai and NCR

Rs 13,500 for other areas

For self–employed – Rs 15,000

The income should be credited directly to the applicant’s bank account. Applicants who get their salaries in cash are not eligible.

Eligibility

We offer personal loans for both, Salaried & Self-Employed. Min CIBIL Score of 600 or Experian of 650. The age limit for application is 21-57yrs. Income must be received in your Bank A/c.

What makes us better?

- Own Credit Model: Get better offers regardless of your credit score

- Easy EMIs: Repay in 3-60 Months at your convenience

- Hassle-Free: 100% Paperless application process

- 100% Transparent: No Hidden Charges, No Surprises!

Easy-to-Apply Process

- Download the moneyview Loans App

- Provide basic details & check your eligibility in 2 mins!

- Choose your loan amount & repayment tenure

- Complete your KYC and verify your income

- Get the money transferred directly to your Bank A/c in a few hours!

ID Proof: Aadhar card or PAN card.

Present address proof if your Aadhar card doesn’t have your current address.

Bank statement of your salary account, showing the salary credits from the last 3 months.

Income Tax Return Verification Form for the last 2 years, if you’re self-employed.

During the submission process, ensure the documents are valid.

Money View Personal Loan Customer Care

You can use any of the following means given below to get in touch with Money View Customer Care:

By Phone: You can call on the company’s customer care number 080-4569-2002

Email: You can also contact the customer care via email. The email address for specific queries are given below:

Loan Payment Queries: payments@moneyview.in

Loan queries: loans@moneyview.in

General queries: feedback@moneyview.in

What factors will lead to a loan application rejection?

There are several factors that could affect your loan application negatively. Let’s take a look at them:

The documents you submitted were incorrect or you don’t have access to all the documents required.

Your in-hand salary is less than Rs.15,000 per month. For self-employed individuals, the application will get rejected if the monthly income is less than Rs.25,000.

Your credit score is not higher than 650, which is standard.

You didn’t clear their credit process verification process.

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla personal loans: Different financial needs, different loans,one app …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual Funds, Fixed Deposits, Personal Loans, Medical Loans, Home …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and start from just 18% per annum. The processing …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of up to 60 months👉🏻 Facility of transferring existing …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where You Can Avail Instant Loans To Fulfill Various …