Instant Online Loan. No Physical Documentation or income proof. Faster Disbursals. Use low interest personal loan to clear high interest credit card debt. Check Eligibility Online. 100% Digital Process. Min. credit score 730+.

Loan for Salaried · Loan for Self Employed

L&T Finance Holdings Limited is a leading non-banking financial company (NBFC) in India that provides a wide range of financial products and services, including consumer loans. L&T Consumer Loans are designed to help individuals meet their various financial requirements, such as purchasing a home, a car, or funding their child’s education.

L&T Consumer Loans are available for salaried as well as self-employed individuals. The loans are offered at competitive interest rates, flexible repayment options, and quick processing times.

Features

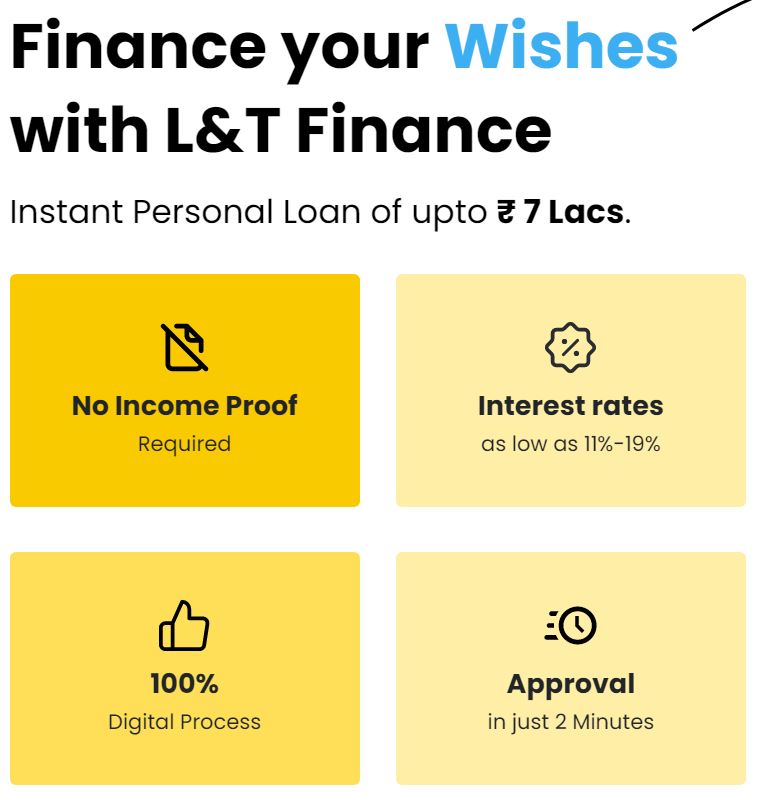

Pre – Approved Limit Upto 7 Lakh

100% Digital Process with Instant Disbursement Facility

No Income Document Required.

Pricing

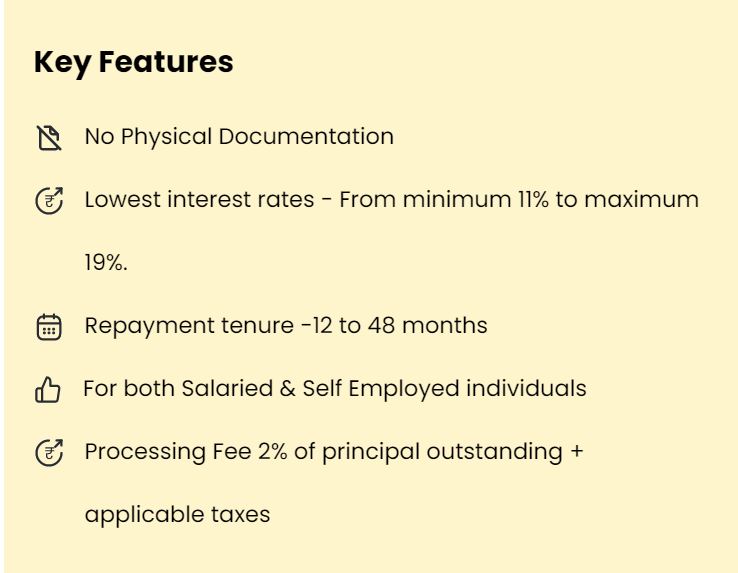

Interest rate – 11% to 19%

Processing fee – Up to 2.25% exclusive of all charges

Documents Required

Aadhar Card

Pan card

Current Address Proof

Back Account Details with E-Mandate Facility.

L&T Finance Holdings Limited offers personal loans to individuals to help them meet their various financial requirements, such as wedding expenses, home renovation, medical emergencies, or travel expenses. L&T Personal Loans are unsecured loans, which means you do not need to provide any collateral or security to avail of the loan.

Here are some key features of L&T Personal Loans:

- Loan Amount: L&T Personal Loans are available for amounts ranging from INR 50,000 to INR 7lakhs, depending on your eligibility.

- Repayment Tenure: L&T Personal Loans come with flexible repayment options, ranging from 12 to 60 months.

- Interest Rates: L&T Personal Loans offer competitive interest rates that are fixed for the entire repayment tenure.

- Eligibility: To be eligible for an L&T Personal Loan, you should be a salaried individual or self-employed professional with a regular source of income.

- Quick Processing: L&T Personal Loans offer quick processing and disbursal of funds, usually within 24-48 hours of loan approval.

- Minimal Documentation: L&T Personal Loans require minimal documentation, making the loan application process hassle-free.

You can apply for an L&T Personal Loan online through the L&T Finance website or by visiting the nearest L&T Finance branch. The eligibility criteria, documentation requirements, and loan terms may vary based on the type of loan and your eligibility criteria.

L&T Consumer Loan – Snapshot ; Loan Amount, From Rs.50,000 – up to Rs.7 lakhs ; Interest Rates, Starts at 11% p.a. ; Repayment Tenure, 12 – 48 months ; Processing ..

FAQ on L&T Loans:

- How much loan can I get with L&T Consumer Loan?

You can get up to Rs.7 lakhs personal loan with L&T Consumer Loan

- What is the interest rate on L&T Consumer Loan?

Interest rates start at 11% p.a.

- How can I repay the loan?

You can repay the loan via ECS or NACH mandate with tenures of up to 48 months.

- Can I make part payments or foreclose my loan?

Yes, you are allowed to make a maximum of 25% of the loan amount as part-payment, twice in a year. Once you have completed 6 EMIs, you can foreclose the loan.

- What is the processing fee on the loan? Are there other fees or charges to be paid?

The processing fee is around 1.75% – 2% of the loan amount. There are no other fees or charges to be paid to get this loan.

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla personal loans: Different financial needs, different loans,one app – ABCD For weddings, travel, vehicle purchases, or any other obligation, fulfil any need with personal finance solutions offered by the ABCD app. …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual Funds, Fixed Deposits, Personal Loans, Medical Loans, Home Loans, and Loan Against Property, Invest Kraft is your trusted partner for all your financial needs. भारत का Super-App | One-stop solution for …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and start from just 18% per annum. The processing fee is up to 2% of the loan amount sanctioned. InCred ensures instant approval on loan and you can repay the borrowed amount …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of up to 60 months👉🏻 Facility of transferring existing loan & credit card balance is available. Get Fullerton India personal loan up to Rs. 25 Lakhs at an interest rate starting from …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where You Can Avail Instant Loans To Fulfill Various Financial Requirements Such As Unplanned Medical Emergencies, Planning A Vacation, Home Renovation Etc. MoneyWide Enables Short And Medium Term Instant Finance Using 100% …

Lnt finance ki active pincode ki jankari ya pdf share kijiye sir, maine dsa ke liye bhi ragister bhi kiya hai. Main aapke help bahut kar sakta hu. Call me sir 7067474417

Send me mail with subject line on mdexim61@gmail.com

mail on mdexim61@gmail.com

https://drive.google.com/drive/u/1/folders/1EG8lP1a5__UPM51lxCnanvLHZIsExP3N

or whatsapp on 9099008561