Stashfin Credit Line Your Superpower to Get Instant Fund.

- Get a credit limit upto ₹10,00,000

- Get 0% interest for up to 30 days

- Select from Flexible Tenure Options upto 36 months

- Pay interest only on the amount utilized

Stashfin is a leading fintech platform with a mission to provide access to fair, fast, and transparent financial products & services for millions of borrowers across India. By providing a simple, clean, efficient and easy to navigate digital platform, Stashfin empowers individuals in helping to take charge of their financial health.

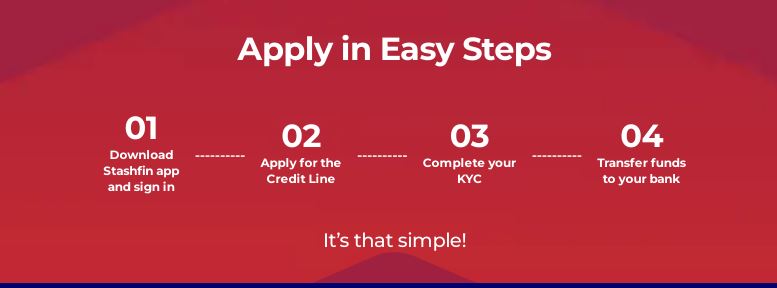

Easy Application

Quick Process

100% Digital

Stashfin serves new-to-credit, prime, and super-prime borrowers with products that have been designed ground-up with our customers in mind. The firm also strives to create opportunities for borrowers with limited credit footprints to participate in the formal financial system, thereby enabling them to build credit scores and successfully embark on a journey of economic freedom.

Credit limit upto ₹10,00,000

Get 0% interest for up to 30 days

StashFin is a digital lending platform based in India that offers personal loans, business loans, and credit cards to individuals and small businesses. The company uses technology and data analytics to provide quick and hassle-free loan disbursals to its customers. StashFin has a user-friendly mobile app that allows customers to apply for loans, manage their accounts, and access customer support. The company offers loans ranging from INR 1000 to INR 5 lakhs, with repayment terms ranging from 3 months to 36 months. StashFin is backed by investors such as Alto Partners, Positive Moves Consulting, and Snow Leopard Technology Ventures.

Why should you take an Instant Personal Loan from Stashfin?

Stashfin offers you the Best in Class Features when it comes to taking a personal loan

A loan limit ranging from as low as ₹1,000 to as high as ₹5,00,000

You select your EMI tenure ranging from 3 to 36 months based on your preference.

You pay interest only on the amount you utilize without any restriction on the withdrawal amount.

You can avail the cash for various needs and not restrict yourself to one use only

StashFin is a popular digital lending platform in India for several reasons:

Quick and hassle-free loan disbursals: StashFin uses technology and data analytics to process loan applications quickly, which means that customers can receive loan disbursals in as little as 4 hours.

Flexible repayment terms: StashFin offers flexible repayment terms that range from 3 months to 36 months, which allows customers to choose a repayment plan that works best for them.

User-friendly mobile app: StashFin has a user-friendly mobile app that allows customers to apply for loans, manage their accounts, and access customer support.

No collateral required: StashFin offers unsecured loans, which means that customers do not have to provide collateral to secure a loan.

Competitive interest rates: StashFin offers competitive interest rates that are based on the customer’s creditworthiness, which means that customers with good credit scores can qualify for lower interest rates.

Overall, StashFin is a good option for individuals and small businesses in India who are looking for a quick and hassle-free way to obtain personal or business loans.

City:

Delhi Chandigarh Bangalore Hyderabad Indore Mumbai Pune Chennai Kolkata Gurugram Noida Lucknow Bhopal Agra Dehradun Kanpur Nagpur Aurangabad Madurai Salem Rajkot Kurnool Vellore Krishna, Andhra-Pradesh Warangal Anantapur Patna Karimnagar Ludhiana.

The eligibility criteria for obtaining a loan from StashFin may vary based on the type of loan and other factors. Here are the general eligibility criteria for personal loans and business loans offered by StashFin:

Personal Loans:

The borrower must be a citizen of India.

The borrower must be between the ages of 18 and 60 years old.

The borrower must have a stable source of income, such as a job or business.

The borrower must have a valid PAN card and an active bank account.

The borrower must have a good credit score.

Business Loans:

The borrower must be a registered business entity, such as a sole proprietorship, partnership, or private limited company.

The business must have been in operation for at least 6 months.

The business must have a minimum annual turnover of INR 10 lakhs.

The business must have a stable source of income.

The business must have a valid PAN card and an active bank account.

The borrower must have a good credit score.

It is important to note that meeting the eligibility criteria does not guarantee loan approval, as StashFin may also consider other factors such as the borrower’s debt-to-income ratio, payment history, and other relevant factors. Additionally, the specific eligibility criteria may vary based on the loan amount, tenure, and other factors.

One loan for all your Needs!..

Travel Loan | Stashfin

Planning to visit your dream destination with your family but running short of cash to fulfill it? Compromise no more! With instant funds from Stashfin, you can plan that most awaited vacation any time. Or are you already in the middle of your travel vacation and running short of cash for those extra spends? Download Stashfin App from wherever you are and apply for a travel loan through a simple process to get funds at your fingertips within minutes.

Marriage Loan | Stashfin

Is your son or daughter getting married soon? Give them their dream wedding with an instant marriage loan from Stashfin. Apply for it with a simple 5-minute application process and disburse the amount you need instantly.

Education Loan | Stashfin

With Stashfin, you can simply fund the education of your kids or provide for higher studies when they want to step up in their careers. The instant personal loan from Stashfin could be used as an education loan to fund the education you have dreamt of.

Medical Loan | Stashfin

Have you got that urgent medical expense of a family member to take care of? The instant personal loan from Stashfin could come in handy as a medical loan for any type of medical surgery you may want, be it cosmetic or regular. You may also use it to pay for major medical expenses.

Home Renovation Loan | Stashfin

Does your house need a repair or a some new furniture pieces to give that different look and feel? Get a house repair loan in the form of instant personal loans from Stashfin.

Consumer Durable Loan | Stashfin

Want to buy that TV or a new refrigerator, or a washing machine? Stashfin has got you all covered its personal loan at the best interest rates and repayment plans. Get a consumer durable loan from Stashfin and be rest assured of the benefits your reap.

Gadget Loan | Stashfin

I will buy this phone 2 years later when the prices reduce. The wait is over now! Get a gadget loan from Stashfin to buy that newly launched mobile phone instantly.

Car Loan | Stashfin

Your first car is waiting for you. Get a new car or even a trusted used car with an instant car loan from Stashfin. Apply through a simplified process and get the best interest rates.

Two Wheeler Loan | Stashfin

Want to buy that new electric two-wheeler? Get a personal loan from Stashfin and buy now.

Example: If a customer takes a loan of ₹10,000 for a period of 3 months, at an annual interest rate of 11.99% APR, then the customer will pay an EMI for 3 months of ₹3,400 per month. Total payment over 3 months will be ₹10,200 (including principal and Interest).

StashFin offers customer support through various channels to assist customers with their queries and concerns. Here are the different ways to get in touch with StashFin’s customer care:

Customer Care Number: Customers can call StashFin’s customer care number at 011-4784-0034 between 9 am to 7 pm from Monday to Saturday. Customers can speak to a customer care representative to get help with their queries.

Email Support: Customers can also email their queries to StashFin’s customer support team at support@stashfin.com. The team will respond to the email within 24 to 48 hours.

Chat Support: Customers can access StashFin’s chat support feature on their website or mobile app to get real-time assistance from a customer care representative. The chat support feature is available between 9 am to 7 pm from Monday to Saturday.

Self-Help Resources: StashFin also provides self-help resources to assist customers with their queries. Customers can visit the StashFin website or mobile app to access the FAQ section, loan calculators, and other resources.

Social Media: Customers can also connect with StashFin on social media platforms such as Facebook and Twitter to get assistance with their queries.

Overall, StashFin offers multiple customer care channels to ensure that customers can get the help they need quickly and easily.

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here are some key details about Aditya Birla …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With a comprehensive range of services including Mutual …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal Loan Interest Rates are very affordable and …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 Only salary slip required🗓 Flexible tenure of …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. MoneyWide Is A 100% Digital Lending Platform Where …