Main Feature:

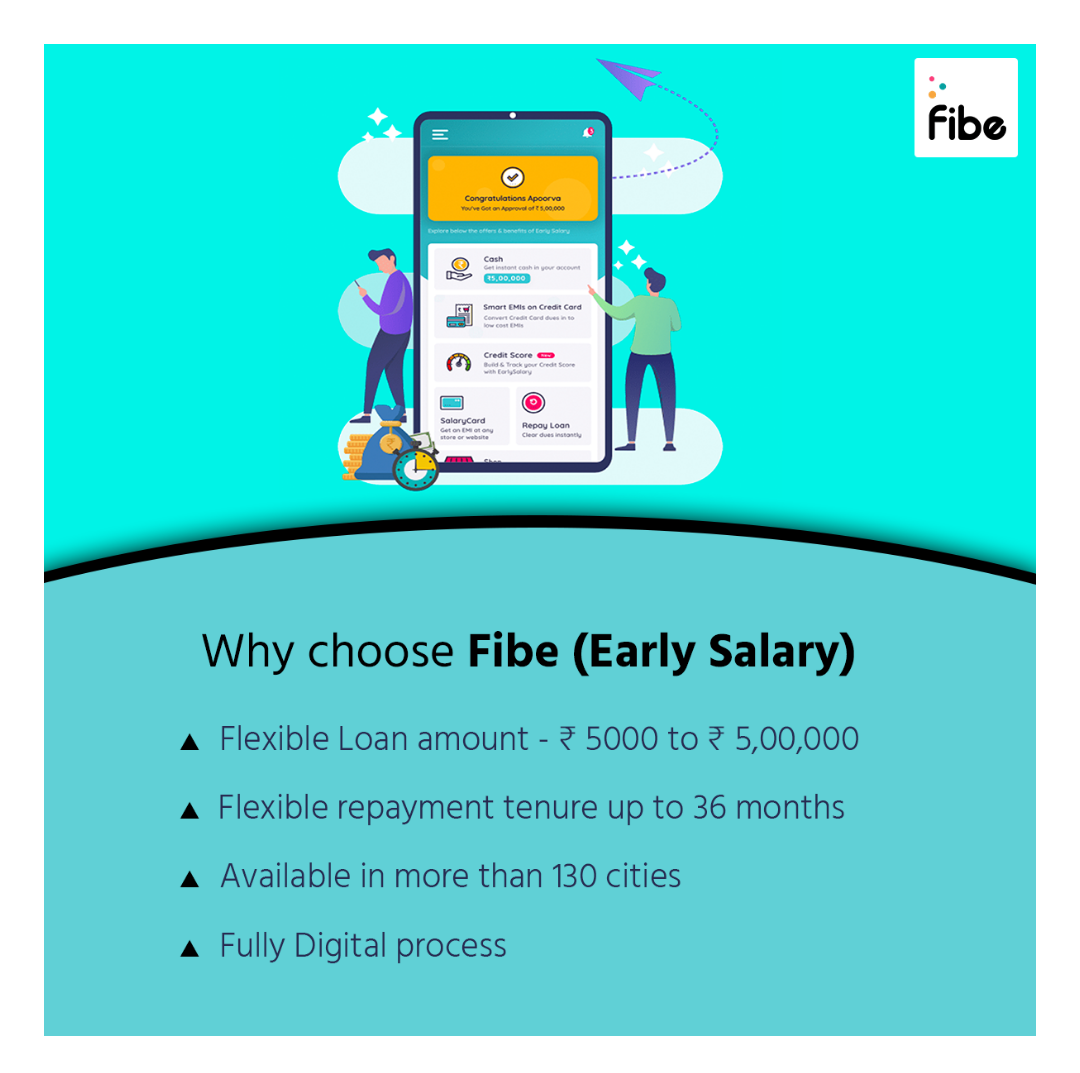

Get instant cash loan of up to ₹5 lakh in 10 minutes with Fibe (Early Salary) at interest rate as low as ₹9/day for Rs.10,000

📝Fully Digital Journey – Zero paper-work.

🏦 Flexible repayment period up to 36 months.

🚫 No Use = No Charge/Fee, No pre-closure charges

📈 Available for credit score above 600

EarlySalary is a digital lending platform in India that offers instant personal loans to eligible individuals. EarlySalary offers short-term loans, which are typically repaid within 2-12 months, with loan amounts ranging from Rs. 5,000 to Rs. 5 lakh.

To apply for a personal loan from EarlySalary, you can download their mobile app and complete the online application process. You will need to provide some basic personal and financial information, such as your name, address, income details, and bank account information.

India’s Largest Instant Personal Loan & Salary Advance.

What Is An Early Salary Personal Loan?

An early or advance salary loan is temporary funding specially designed for salaried professionals. Unlike personal loans, lenders calculate interest rates monthly or daily on early salary loans. It is also known as the payroll loan.

One of the notable advantages of these loans is they are also available to people with moderate credit ratings. Additionally, many lenders pay off payroll prepayment loans in hours, if not minutes. These payroll advance loans also have a very high Annual Percentage Rate (APR) due to fast processing time and high risk.

Although the repayment terms are favourable to the lender, these loans can help those in urgent need of funds. Therefore, it is preferable to choose these loans only in an emergency when you have no other alternative..

Fibe Instant Cash Loan

Purpose: Instant cash loan is an unsecured loan, which borrowers can avail to meet their emergency expenses such as home repair, unplanned travel or sudden medical expenses.

Loan amount: Rs 5,000 to Rs 5 lakh.

EarlySalary Personal Loan Eligibility Criteria

Indian resident

Age: Between 21 and 55 years old

Salary:

Minimum salary should be Rs 18,000 (for metro cities)

Minimum salary should be Rs 15,000 (for non-metro cities)

Documents Required for EarlySalary Personal Loan

A selfie/passport size photograph

Identity proof: Passport/Aadhaar card/PAN Card/Driving License

Address proof: Passport/Rental agreement/Utility bills/Voter ID

Income proof: Bank statements and salary stubs for the last 3 to 6 months

Note: All the documents required for personal loans should be submitted in PDF format.

Fully Digital Journey

No long forms. No paper-work. Just fill in some details and get instant cash.

Looking for a Personal loan? Fibe is a one stop solution for all your instant cash needs/n/nReasons to apply for Fibe:/n

✅ 100% online application process/n

✅ Loan tenure up to 36 months/n

✅ Quick loan disbursal /

Use link and Download the Fibe app today – Click here

Login to your account Click here

- Quick and easy loans for all DreamsAditya Birla Capital Limited (ABCL) offers a variety of financial products and services, including personal loans. Here …

- InvestKraft join BenifitsInvest Kraft is a leading financial services provider dedicated to helping individuals achieve their financial goals. With …

- InCred Finance – Insta LoanGet instant online personal loan up to Rs. 2 lakhs from InCred with minimal documents. InCred Personal …

- Get your personal loan eligibility in minutes !Get instant Personal loan Fullerton of up to ₹20 lakh. #ListenToYourHeart📊 Interest rate starting from 11.5% p.a.💸 …

- MoneyWide Instant Loan within 3 hoursMoneyWide Is A 100% Digital Lending Platform Owned And Operated By MyLoanCare Ventures Private Limited, A Registered NBFC. …